Options theta explained

Table of Contents

What is theta?

It’s the rate of change of an option’s price concerning time. Specifically, it is the amount by which the price of an option declines every day as it approaches expiration. Theta is also sometimes referred to as the ‘time decay’ of an option.

Why is theta significant?

It is important because it represents the time value component of an option’s premium (the other component being intrinsic value). All else being equal, the closer it gets to expiration, the less time value it will have and the faster its price will decline due to time decay.

How can you use theta in trading?

There are a few different ways traders can use it in their trading. One way is to take advantage of it by selling options nearing expiration. It is sometimes referred to as ‘playing theta’.

Another way to use it is to help manage risk. For example, if you are long a call option with a theta of -0.50, the option will lose $0.50 in value every day. You may want to consider closing out a position before it loses all its value due to time decay.

Finally, traders can also use it to help them gauge their level of exposure to time decay. For example, if you long a call option with it of -0.50 and short a put option with it of +0.50, your net theta exposure is 0. It means that, daily, time decay is not likely to impact your position significantly.

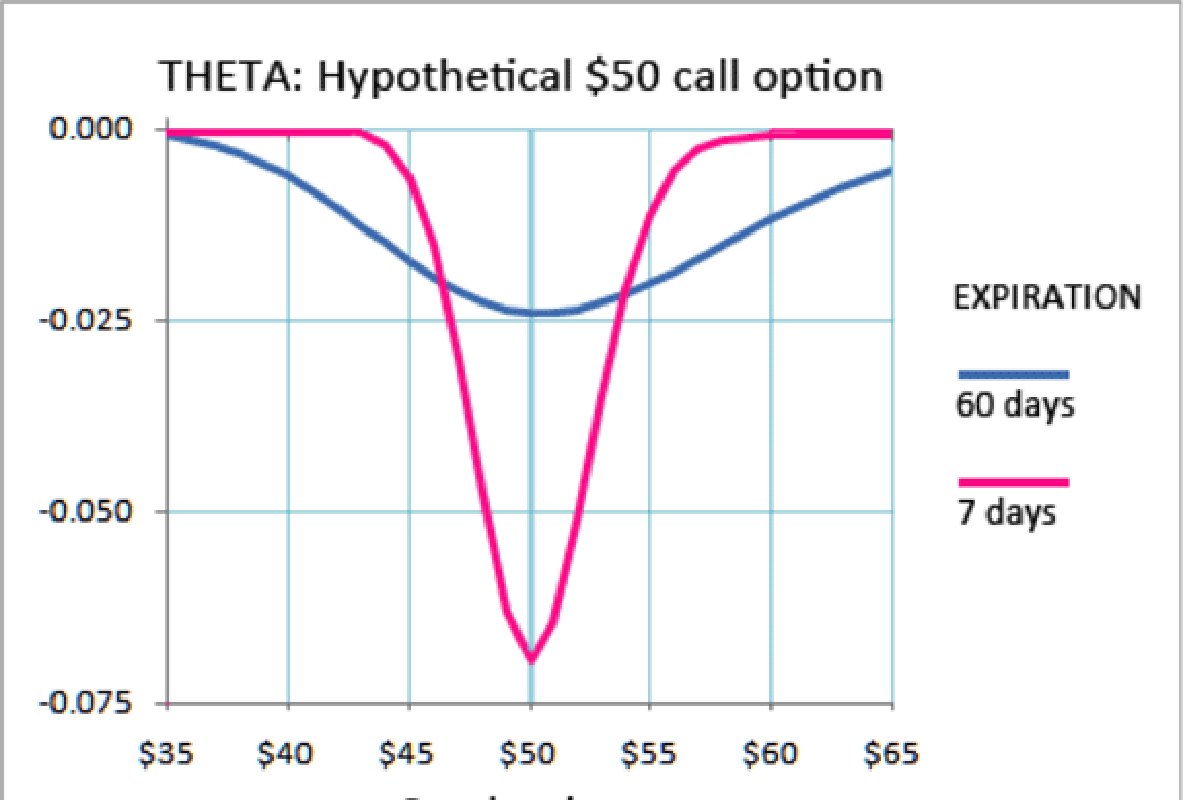

All things being equal, the theta will be:

- Higher for shorter-term options

- Higher for options with higher volatility

- Lower for options with lower strike prices (in-the-money options)

- Lower for options with higher strike prices (out-of-the-money options)

It can significantly impact an option’s price, especially as expiration approaches. As such, traders need to understand how it works and how it can be used in trading.

Benefits of using theta in trading

It represents the time value component of an option’s premium. The time value is the amount of an option premium attributable to the amount of time remaining until expiration. The closer to expiration, the less time value it will have. As such, it can be used to gauge an option’s time value.

It represents the rate of change in an option’s price concerning time

Theta measures how fast an option’s price declines as it approaches expiration. This information can help manage risk and exposure to time decay.

It can be used to take advantage of time decay

Since theta represents the rate of decline in an option’s price, traders can use it to their advantage by selling options nearing expiration. It can help manage risk; It can help manage risk and exposure to time decay. By understanding how it affects an option’s price, traders can better decide when to close out their positions.

It represents the time value component of an option’s premium

Finally, this means the time value is the amount of an option premium attributable to the amount of time remaining until expiration.

Risk of using theta in trading

It can significantly impact an option’s price, especially as expiration approaches. Moreover, it represents the rate of change of an option’s price concerning time, and it can be used to help manage risk and exposure to time decay.

It can be used to help manage risk. However, if you don’t understand how theta affects an option’s price, you could make poor trading decisions and it itself could become a risk.

For example, while it can be used to gauge exposure to time decay, it should be used with other factors, such as vega, to make more informed trading decisions.

Follow the link if you want to trade options UK with theta.