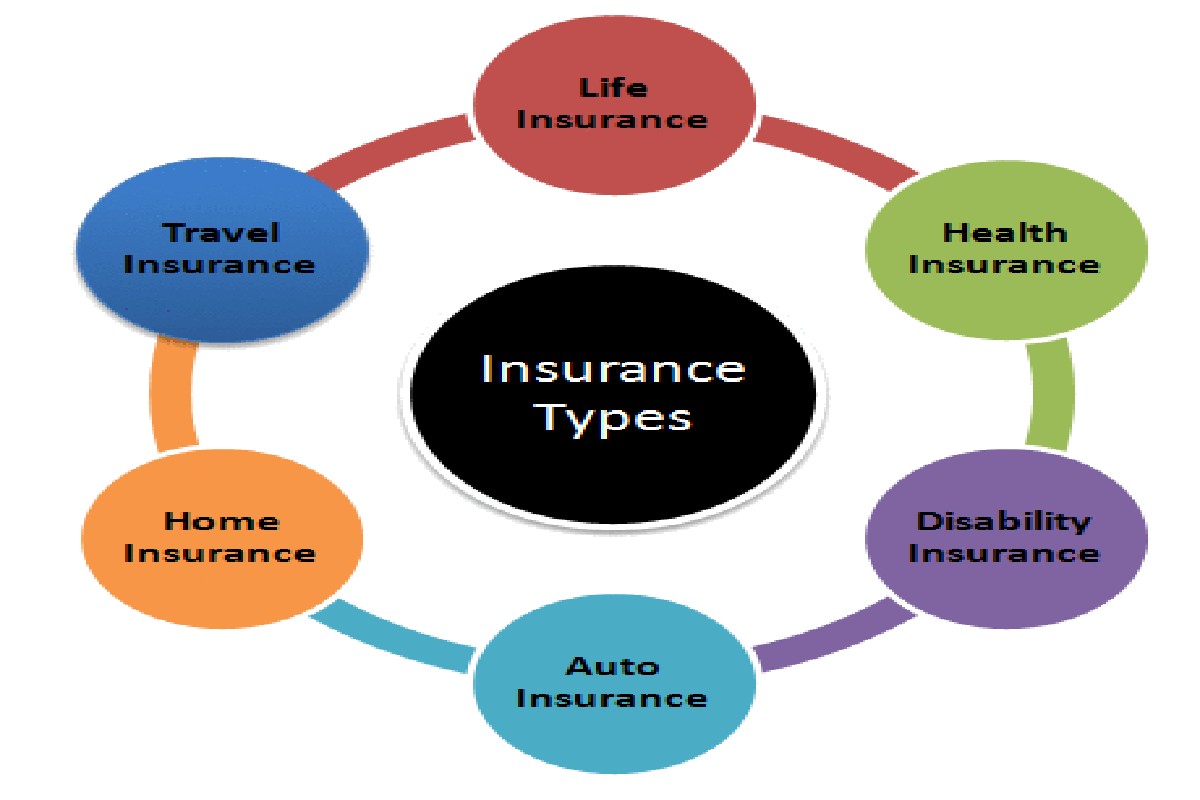

What are the different types of insurance

Are you an entrepreneur looking to start a business and trying to understand things like what is the primary industry and how to start a business in it? Or did you just get married and are excited to start a new family. Regardless of where you are in life, you need insurance to protect your dreams, aspirations and family. However, understanding it can be a bit complicated. So we have made a list of some of the most common it, so that the next time you meet an agent you don’t get lost in the jargon:

-

Table of Contents

Health insurance

It covers the insured’s medical expenses arising from illness or injury. This type of insurance is beneficial for people who don’t have employer-provided health insurance or who are at high risk for health problems.

There are two types of health insurance: individual plans and family floater plans. A separate plan covers the proposer only, while a floater plan covers the proposer along with his/her spouse, dependent children, and dependent parents. Some insurers also offer emergency assistance and ambulance cover as add-on benefits under their policies.

Some It policies also offer cashless treatment facilities at selected hospitals, where they have tie-ups with the insurer. Under such policies, one can get treatment without paying any money to the hospital upfront. The insurer directly settles the bill with the hospital, and you only need to pay the excess.

It is mandatory in India if you want to drive your car on public roads. It covers both liability and damage to third-party property and damage to your vehicle due to any unforeseen incidents like accidents, theft, natural calamities, etc. Also, with increasing road rage incidents, deciding the amount according to your policy coverage makes sense.

-

Car Insur

cover yourself with a comprehensive car insurance policy that also has personal accident cover.

-

Travel Insurance

What if you are robbed of your luggage while vacationing abroad? What if you get injured in an accident while on a cruise? If you have travel insurance, these expenses will be covered by your insurance company. It also covers the loss of passports and other legal expenses.

-

Education Insurance

It is a life insurance plan in which the insured can receive a lump sum amount to fund his child’s higher studies. Moret is bought by an adult (usually the parent) for their minor children. Upon the maturity of the policy, the fund can then be used to pay for tuition fees, boarding and lodging expenses, etc.

-

Term Insurance

It is a type of life insurance that provides income replacement if the insured dies within a specified period. If you have financial dependents, term plans are best suited for you. Under this plan, you will receive a lump sum amount as a death benefit in case of demise during the policy tenure or else it will lapse.

-

Life insurance

When we think of the functions of insurance, we are mostly thinking about life insurance since this is the most common type. It provides financial protection to your family in case of an unfortunate event like the death of the insured. The policyholder pays a certain amount as a premium and in return, the insurer provides a lump sum amount to the policyholder’s family or nominee if something untoward happens to the policyholder.